DTI Application for Sole Proprietorship 2018-2026 free printable template

Show details

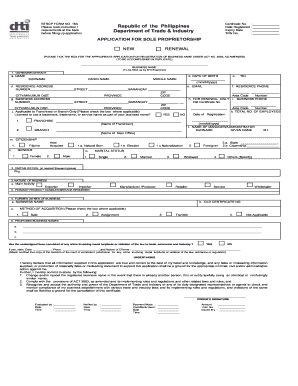

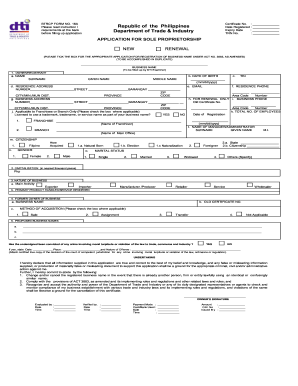

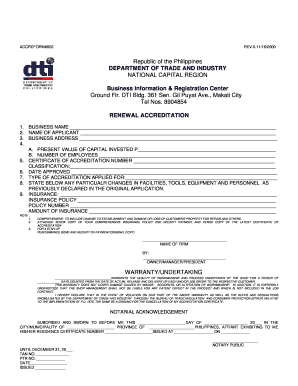

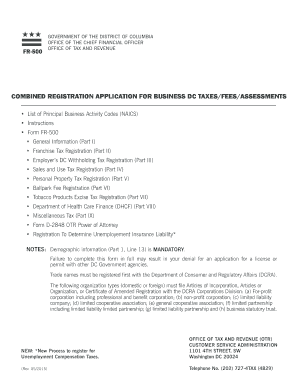

A. TYPE OF DTI REGISTRATION 1. NEW RENEWAL Certificate No. B. TAX IDENTIFICATION NO. TIN Date registered With TIN Owner s TIN C. A. Type of Registration 1. DTI Registration Type. Tick the appropriate box for your business. New Registration Type to be selected if applicant wishes to register a New BN. Renewal - Registration Type to be selected if applicant wishes to renew an expiring/expired BN. B. Republic of the Philippines Department of Trade and Industry BNR Form No* 01-2018 2018...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dti registration form

Edit your dti sole proprietorship application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dti registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dti application for registration online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form download fillable. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DTI Application for Sole Proprietorship Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dti registration online form

How to fill out DTI Application for Sole Proprietorship

01

Visit the official DTI website or the nearest DTI office.

02

Obtain the application form for Sole Proprietorship.

03

Fill out the basic information required, such as your name, address, and contact information.

04

Specify your business name and make sure it complies with DTI guidelines.

05

Provide a brief description of your business activities.

06

Indicate the location of your business operations.

07

Attach any required identification and supporting documents.

08

Review your application for accuracy before submission.

09

Pay the necessary registration fees as indicated by DTI.

10

Submit your completed application form along with the payment receipt.

Who needs DTI Application for Sole Proprietorship?

01

Individuals planning to start a business as a sole proprietor.

02

Existing sole proprietors looking to register or legalize their business name.

03

Entrepreneurs seeking legal recognition for their business activities.

Fill

dti business name registration

: Try Risk Free

People Also Ask about dti online registration

How to register a business in the Philippines?

Basic Requirements and Procedure in Registering a Sole Proprietor Business Register a business name at Department of Trade and Industry (DTI) Register your business with the Bureau of Internal Revenue (BIR) Registration with Barangay. Register your business in the Mayor's Office.

Do I need to register my ecommerce business Philippines?

You need to register with BIR. You must issue invoices, receipts for any sale or receipt of payment. Record transactions in books of account. File tax returns and pay taxes and submit applicable reportorial requirements.

How do I register an online company in the Philippines?

Register your business name in the Department of Trade and Industry (DTI) Prepare your business name. Confirm the availability of your business name. Fill up the online registration form. Pay the registration fee. Download your certificate.

Do I need to register my small business Philippines?

All businesses in the Philippines are required to apply for a certificate of registration with the BIR. It enables taxpayers to pay their taxes and enjoy the benefits of having a legal business.

How much does it cost to register an online business in the Philippines?

Pay the P500.00 Registration Fee and P30.00 loose Documentary Stamp Tax (DST). Taxpayer-applicant with existing Taxpayer Identification Number (TIN) may pay the P500.00 Registration Fee and P30.00 loose DST online through the following ePayment Channels of the BIR.

Do I need to register my online business in Philippines?

Even if your business is online, you have to go and register your business at the nearest BIR Regional District Office (RDO). Your RDO code depends on where you are based, like your home or business address. If you're not sure where your RDO code is you can check out this online source to help you out.

How do I contact DTI?

You may also reach us through the DTI Hotline at 1-834 (1-DTI)or at 0917 834 3330.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the pdf download in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your dti form for business registration right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the online registration dti form on my smartphone?

Use the pdfFiller mobile app to fill out and sign dti certificate of registration. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete dti registration form download on an Android device?

Use the pdfFiller mobile app to complete your dti permit online on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is DTI Application for Sole Proprietorship?

The DTI Application for Sole Proprietorship is a registration process that allows individuals to legally establish and operate a business under their own name or a registered business name in the Philippines.

Who is required to file DTI Application for Sole Proprietorship?

Individuals who wish to start a sole proprietorship business in the Philippines are required to file a DTI Application for Sole Proprietorship.

How to fill out DTI Application for Sole Proprietorship?

To fill out the DTI Application for Sole Proprietorship, one must provide their personal information, proposed business name, business address, and other relevant details on the application form available on the DTI website or at DTI offices.

What is the purpose of DTI Application for Sole Proprietorship?

The purpose of the DTI Application for Sole Proprietorship is to legally recognize and protect the business name of the sole proprietorship, ensuring that the owner can conduct business under that name.

What information must be reported on DTI Application for Sole Proprietorship?

The information that must be reported on the DTI Application for Sole Proprietorship includes the owner's full name, address, proposed business name, business address, and the nature of the business.

Fill out your DTI Application for Sole Proprietorship online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dti Registration Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to dti business registration

Related to how to register in dti online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.